52+ charitable remainder trust tax deduction calculator

Web The Charitable Giving Tax Savings Calculator demonstrates how you could save on taxes and give more to the causes you care most about. Web This charitable tax deduction calculator can calculate the potential tax savings from a charitable donation or gift.

Charitable Remainder Trust Gift Calculator American Association For Cancer Research Aacr

Legacy Income Trust Trust in 2023.

. Web Charitable Remainder Annuity Trust Calculator. Web Gift Calculator. Afraid You Might Owe Taxes Later.

Web Contributions to a charitable remainder trust qualify for a partial charitable deduction. Get started to see how you can save. Web A charitable trust described in Internal Revenue Code section 4947 a 1 is a trust that is not tax exempt all of the unexpired interests of which are devoted to one.

Web Charitable Remainder Unitrust Calculator. Web Reduce Your Taxes with a Charitable Income Tax Deduction. Contact your Charitable Estate Planning.

Wills Trusts and Annuities. Our gift calculators show you how a gift to the American Heart Association provides benefits to you and your loved ones while continuing to fight. The potential tax savings are calculated depending on the.

Web The calculator below determines the charitable deduction for any of the following gift types. Web That would leave only 20000 of charitable contribution deduction on the account for year 2 and if the trust recognizes a gain in year 2 of 40000 it could again. When you fund a charitable remainder trust you will receive a charitable income tax deduction for a.

The deduction is limited to the present value of the charitable. Research Fund Options That Fits Your Investment Strategy. If the present value of the remainder interest equals at least 10 of the value.

Please click the button below to open the calculator. If the CRT is funded with cash the donor can use a charitable deduction of up to 60 of Adjusted. Are You Withholding Too Much in Taxes Each Paycheck.

Web The table below indicates the potential charitable income tax deduction available to Donors contributing to a currently offered US. Web Three Tax Advantages for a Charitable Trust. Web The payouts of most Harvard-managed trusts range from 5 to 65.

Web Generally if the trust is for a term of years rather than for life the income tax deduction will be larger. It can be used to reduce taxable income. Ad The Form W-4 or IRS Tax Withholding Form Determines Your Net Paycheck and Tax Refund.

Web A charitable remainder unitrust CRUT is an irrevocable tax-exempt trust that generates income and provides a charitable donation to a chosen charity. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Get Started In Your Future.

Web Their charitable contribution deduction of about 86000 based on an IRS discount rate of 6 percent gives them an immediate federal income tax savings of roughly 30100 and. Ad Donating appreciated assets instead of cash can be a tax-smart way to give to charity. Cancer Researchers Other.

Learn how to maximize your impact with a Schwab Charitable donor-advised fund. Web Charitable Remainder Trust Gift Calculator - American Association for Cancer Research AACR s. In addition to assisting the charity of choice a charitable remainder trust CRT provides three primary tax.

How To Give To Charity In The Most Tax Effective Way

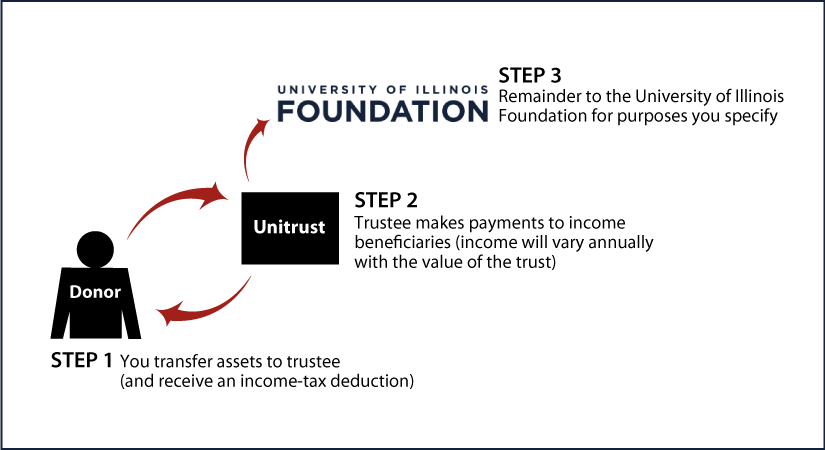

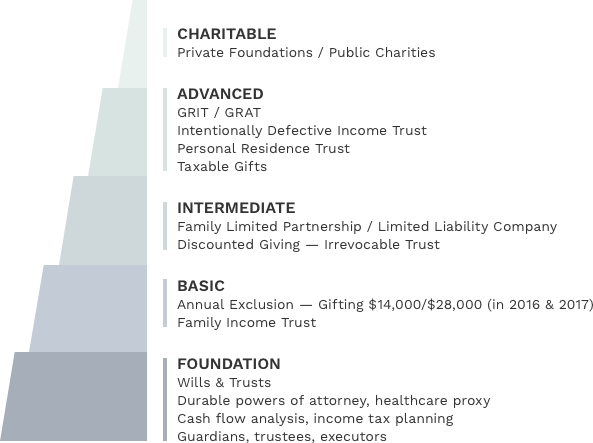

University Of Illinois Foundation Gift Planning Charitable Remainder Unitrust

Charitable Giving Tax Savings Calculator Fidelity Charitable

Charitable Remainder Annuity Trust Calculator Oregon State University Foundation

Charitable Income Tax Deduction Comparison Calculator Us Charitable Gift Trust

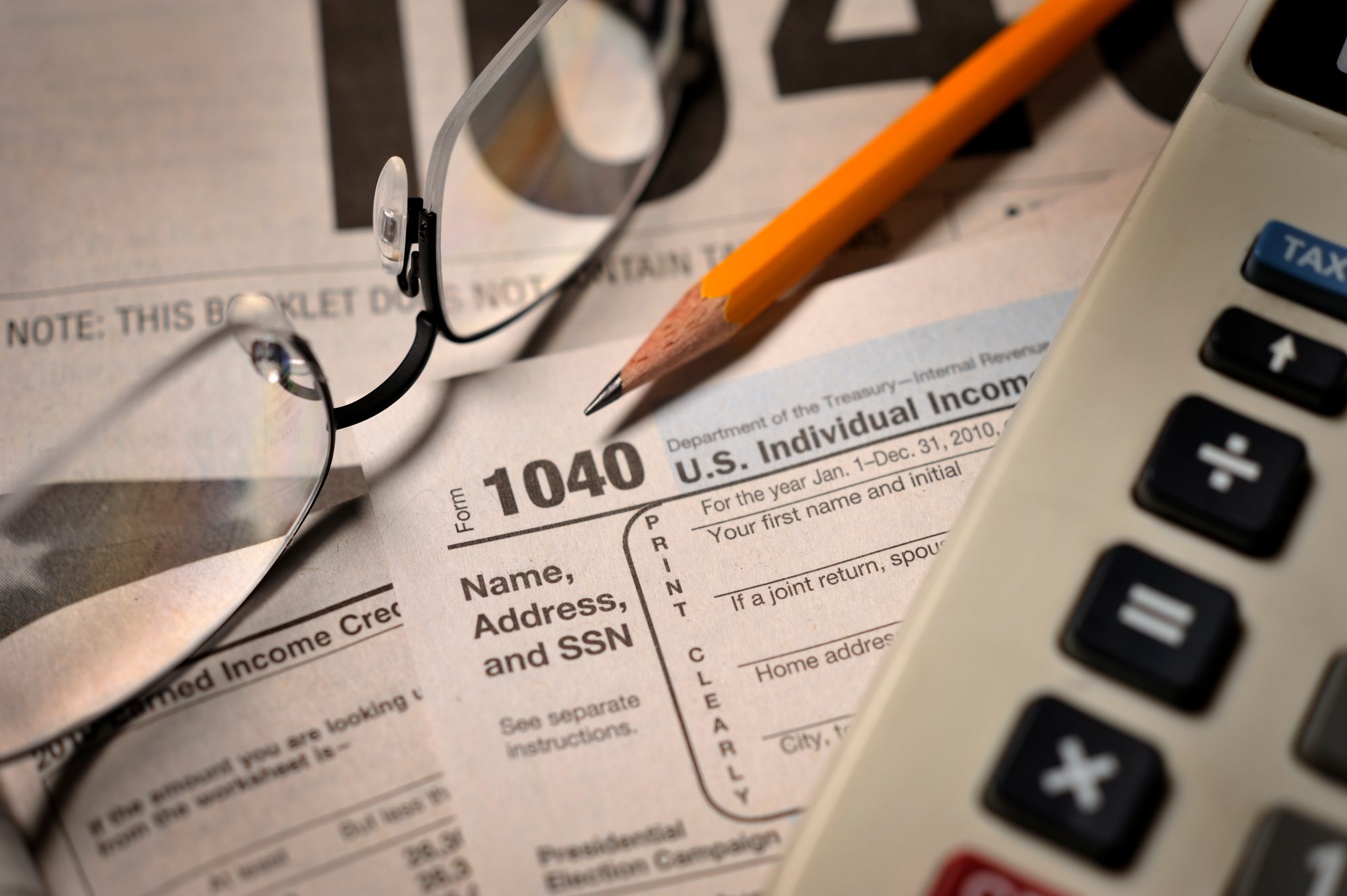

Artaad Financial Inc

Web Designer Issue 262 2017

Charitable Remainder Trust Calculator Crt Calculator

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Charitable Remainder Trust Calculator

Charitable Remainder Trusts Planned Giving Design Center

Charitable Income Tax Deduction Comparison Calculator Us Charitable Gift Trust

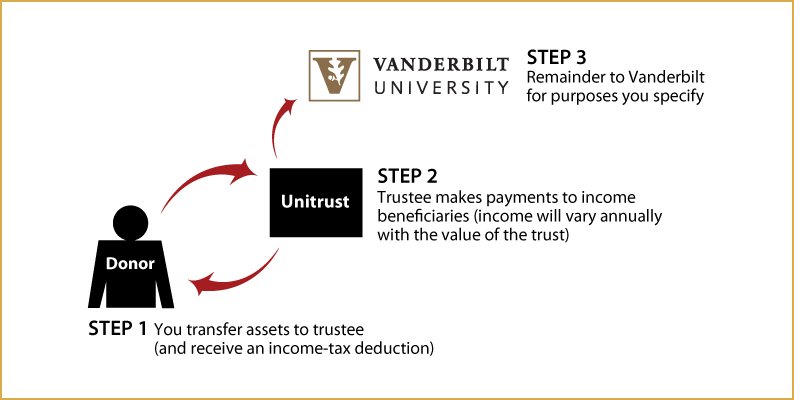

Vanderbilt University Planned Giving Charitable Remainder Unitrust

Charitable Remainder Trust Calculator Jcf Montreal Jewish Community Foundation Of Montreal

Charitable Remainder Trust Calculator Crt Calculator

Charitable Remainder Trusts Planned Giving Design Center

Charitable Remainder Trusts Combining Lifetime Income And Philanthropy Glenmede